- Battery-grade lithium hydroxide prices in Asia were steady in active markets with consumers focused on securing materials.

- The battery-grade lithium carbonate price range in China stayed intact with some cheap technical-grade units disappearing after some traders finished profit-taking activity.

- Europe, US markets remain tightly supplied due to shipping delays, but the price held this week.

Battery-grade lithium hydroxide prices in Asia remained firm, with suppliers reportedly struggling to meet demand while consumers prioritized the security of materials.

“My priority right now is to restock as many lithium hydroxide [cargoes] as possible,” a consumer said.

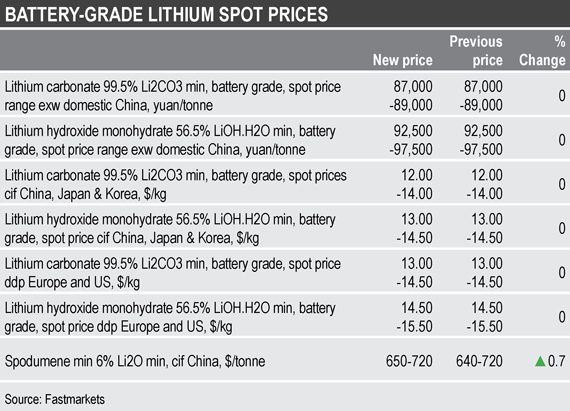

Fastmarkets’ weekly assessment for the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price range, exw domestic China held at 92,500-97,500 yuan ($14,467-15,249) per tonne on June 10, unchanged from previously.

Spot business was active with consumers attempting to secure units for June delivery in the past few weeks to support their operations that are broadly running at full rates amid robust demand for nickel-rich nickel-cobalt-manganese (NCM) lithium-ion batteries. This battery typically feeds on lithium hydroxide.

“Current momentum of demand for nickel-rich NCM batteries had not been anticipated by the majority of market participants,” a producer said. “Even in the third quarter last year, we didn’t see that coming.”

“Everything needs to be settled before mid-June, otherwise buyers can barely find anything on the spot market,” a producer said.

The situation was similar in seaborne Asian countries, including Japan and South Korea, where suppliers and buyers are also negotiating quarterly contractual prices within their annual long-term contracts.

Fastmarkets’ weekly price assessment for lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea was $13.00-14.50 per kg on Thursday, unchanged from one week ago.

More suppliers made aggressive offers, with some of them nudging higher over $15 per kg, market participants told Fastmarkets, anticipating strength in the spot market in the second quarter will be factored into contractual prices for the third.

In the carbonate complex, prices for the battery raw material in both domestic China and seaborne Asian markets were stable.

Fastmarkets’ weekly price assessment for lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price, cif China, Japan and Korea was flat at $12-14 per kg on June 10.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot price range exw domestic China unchanged week on week at 87,000-89,000 yuan per tonne on the same day.

Technical-grade compounds underpins Europe, US battery-grade market

Spot lithium prices in Europe and the United States continued to be underpinned by tight availability of technical-grade compounds and logistics delays that are exacerbating the supply tightness amid recovering demand, sources said.

Fastmarkets’ weekly assessment of the lithium carbonate, 99% Li2CO3 min, technical and industrial grades, spot price, ddp Europe and US widened up to $12.50-14.50 per kg on June 11, up around 1.89% week on week from $12.50-14.00 per kg on June 3 and posting a fifth consecutive weekly increase since the beginning of May.

“The shipping delays are not the fundamental reason why [lithium] prices are higher but it is adding to the tight supply picture,” an upstream source active in Europe and seaborne Asia said.

“We are sold out on Q3 deliveries already… a lot of customers were keen to secure their volumes for the third quarter…..Everything is very tight in Europe and prices are expected to increase,” the same source added.

“We do ship some small volume in Europe [from China] and have seen a significant increase in freight costs, although due to the limited volumes shipped we did not have issues in securing containers space,” a refiner active in Asia and Europe said.

“We also experienced some delays in receiving raw material from South America due to the shipping delays,” the same source added.

The lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US was steady week on week at $13.00-14.50 per kg on Thursday.

The corresponding lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US was also unchanged for the third week in a row at $14.50-15.50 per kg.

The container shortage is being significantly compounded by a period of restocking in the wake of Covid-19 along with massive congestion in ports.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China for June includes all trades, bids and offers reported to Fastmarkets.