- Battery-grade lithium hydroxide prices in both the domestic Chinese and seaborne Asian markets edged up amid tight availability and robust demand.

- The battery-grade lithium carbonate price in China continued its marginal downturn amid a supplier-buyer stand-off, while the price in the seaborne Asian market remained firm.

Tight supply of battery-grade lithium hydroxide, which is partially due to the limited number of accredited producers in China, has prompted consumers to accept offer hikes. Moreover, most market participants anticipate the nickel-rich lithium-ion battery feedstock price to tick up further in the near future.

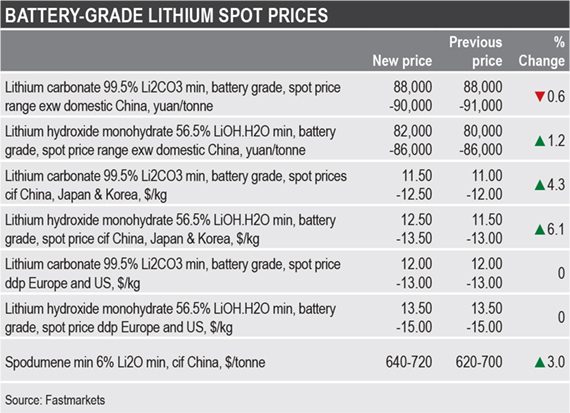

Fastmarkets’ price assessment for lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price range exw domestic China rose to 82,000-86,000 yuan ($12,677-13,295) per tonne on Thursday, up by 1.2% from 80,000-86,000 yuan per tonne one week ago.

“There is only a limited number of suppliers in China you can seek materials from,” a consumer said. “In addition, consumers are hold robust appetites due to healthy downstream demand from the electric vehicle sector.”

The price for lithium spodumene, which Chinese lithium hydroxide producers use in their operations, continued to post gains in light of limited supply in Australia.

Fastmarkets’ latest assessment for spodumene 6% Li2O min, cif China was at $640-720 per tonne on April 28, up by 3.03% from $620-700 per tonne on March 31. The raw material price has ticked up nearly 80% from November when the price started its recent rally.

Some market participants told Fastmarkets they expect the tightened restrictions in Chile, a key lithium supplier in South America, to translate into shipment delays from May onward.

“The cargoes were mostly delivered to China on schedule in April; however, we are not sure at this point whether the shipments will be on time in May,” a trader said.

The battery-grade lithium hydroxide price in the seaborne Asia market also nudged higher in the past week due to higher offers and expectations for further gains amid tightening supply and strength in the domestic China market.

Fastmarkets’ price assessment of the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea rose to $12.50-13.50 per kg on April 29, up by 6.12% from $11.5-13 per kg previously.

Lithium carbonate price weakens in China

The battery-grade lithium carbonate price in China edged lower on Thursday amid a stand-off between suppliers and consumers, as well as traders’ profit-taking.

Fastmarkets’ price assessment for lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price range exw domestic China dropped to 88,000-90,000 yuan per tonne on April 29, down by 0.56% from 88,000-91,000 yuan per tonne previously.

“Traders have already had good margins, therefore, once the price upturn was capped, they intended to take profits,” a second consumer said.

After hitting the highest level since August 2018, domestic battery-grade lithium carbonate price failed to make any further gains from 88,000-92,000 yuan per tonne in early April before it started to soften, according to Fastmarkets data.

“The stand-off persisted in April, but both parties are expected to try to bridge the expectation gap following the Labor Day holiday [May 1-5],” the first trader said, adding that active spot trades might resume in middle or late May.

Elsewhere in Asia, the battery-grade lithium carbonate price in the seaborne market continued to be supported by supply constraints.

Fastmarkets assessed the weekly assessment of the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price cif China, Japan and Korea at $11.50-12.50 per kg on April 29, up by 4.35% from $11-12 per kg one week ago.

Tightness prevails in Europe, US Lithium carbonate market

The lithium spot markets in Europe and the United States remained underpinned this week, with the carbonate segment tight and buyers that are not covered by long-term contracts struggling to find spot units, sources said.

Fastmarkets’ lithium carbonate 99% Li2CO3 min, technical and industrial grades, spot price ddp Europe and US stood at $11.50-12.50 per kg on Thursday April 29, up from $11-12 per kg a week prior and posting a third consecutive weekly increase.

“I think in the United States [where I am active other than seaborne Asia] there is still a premium [for lithium compounds] compared with the seaborne Asia consuming region,” a trader active in both regions said.

The same source added that buyers do not have much bargaining power due to the lack of supply.

Battery-grade lithium spot prices remained unchanged over the past seven days following earlier increases.

Fastmarkets’ latest price assessment for lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US was $12-13 per kg on Thursday, unchanged for two consecutive weeks but up 4.2% from $11.50-12.50 per kg from April 15.

And Fastmarkets’ assessment for the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US was $13.50-15.00 per kg on the same day, unchanged for the past two weeks but up 5.6% from April 15.

Learn more about Fastmarkets’ lithium pricing methodology and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China includes all trades, bids and offers reported to Fastmarkets.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.