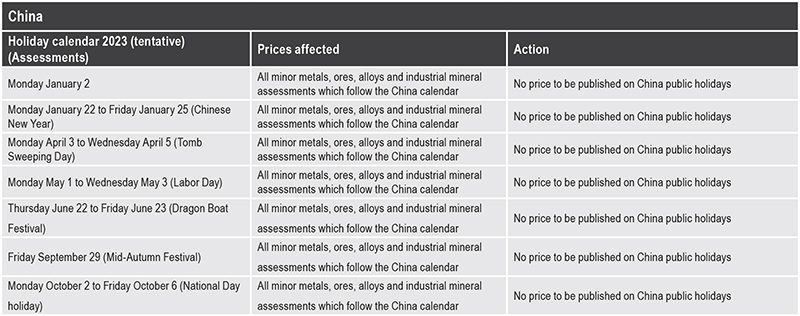

Prices (of any frequency) that are solely assessed by our team in China will not be assessed or published at all on Chinese public holidays.

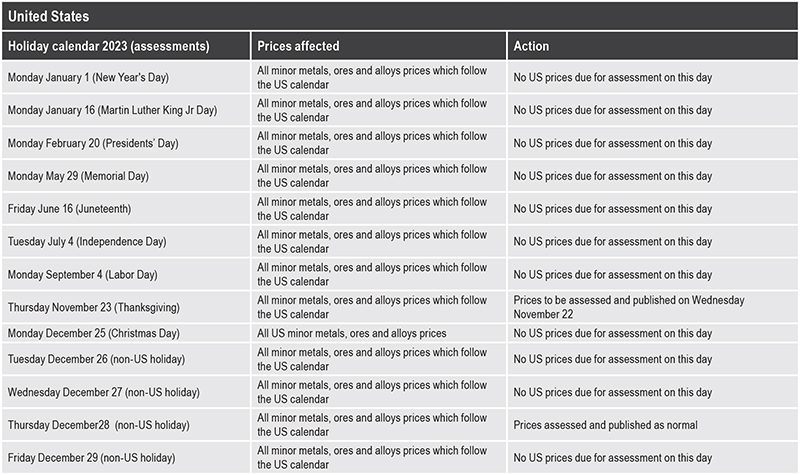

Daily and twice-weekly prices assessed in any location will also not be assessed or published on relevant public holidays.

In Europe and the United States, less frequent price assessments (weekly, fortnightly, monthly, quarterly) will be made on the closest working day in the same month of the scheduled price assessment (see tables below for exact dates). If there are two such potential days, the price will be assessed on the day before the public holiday.

All prices which follow the calendars for England and Wales, and the US, will be published as normal during all working days, including those between Christmas and New Year. This will be a change from earlier practice, when they would have been rolled over.

The consultation period for this proposed amendment starts on Wednesday, February 23 and will end on March 23. The 2023 holiday calendar will then be confirmed and published, subject to market feedback.

The published 2022 calendar will not be affected by these changes. Price indices (such as those for manganese ore, cobalt hydroxide and UG2 chrome ore) will also not be affected.

Please note that Fastmarkets has already separately opened a consultation on potential changes to the pricing calendar for cobalt metal in-warehouse Rotterdam, which are due to take place from March 2022. This notice does not affect cobalt pricing any further, but will bring other prices into line with cobalt from 2023.

Further details on pricing

Fastmarkets’ price assessments for minor metals, ores, alloys and industrial minerals in 2023 will follow the holiday calendar of the country in which the price is based or in which the team assessing the price is based (England, US, China).

This means that prices assessed by the London or other-Europe-based team members, for instance, will follow public holidays in England and Wales. Prices assessed in Shanghai will follow Chinese public holidays, and so on.

Prices for lithium cif China Japan Korea, all spodumene prices, cobalt hydroxide payables, imported charge chrome cif China, and Turkish chrome ore cfr China, are assessed jointly in London and China, and will follow the England and Wales holiday schedule shown below. They will be assessed as normal on holidays in China. Price assessments for high-carbon ferro-chrome, cif Japan and South Korea, will follow the China schedule.

Please note that this notice does not include ferro-nickel. Ferro-nickel, as a London Metal Exchange-related discount/premium, follows the base metals calendar. Nickel sulfate also follows the base metals calendar.

Below are the public holidays in the regions affected.

Proposal (subject to confirmation following consultation)

To give feedback on the above proposal, or if you would like to provide price information by becoming a data submitter to these prices, please contact Fastmarkets global IMMOA editor Fleur Ritzema by email at pricing@fastmarkets.com. Please add the subject heading: ‘FAO Fleur Ritzema, re changes to pricing calendar.’

To see all of Fastmarkets’ pricing methodology and specification documents, go to https://www.fastmarkets.com/about-us/methodology.