To read our most recent insights into lithium supply and demand in 2023 and beyond, take a look at our lithium market outlook. Read now.

What’s the balance of lithium supply and demand in 2021?

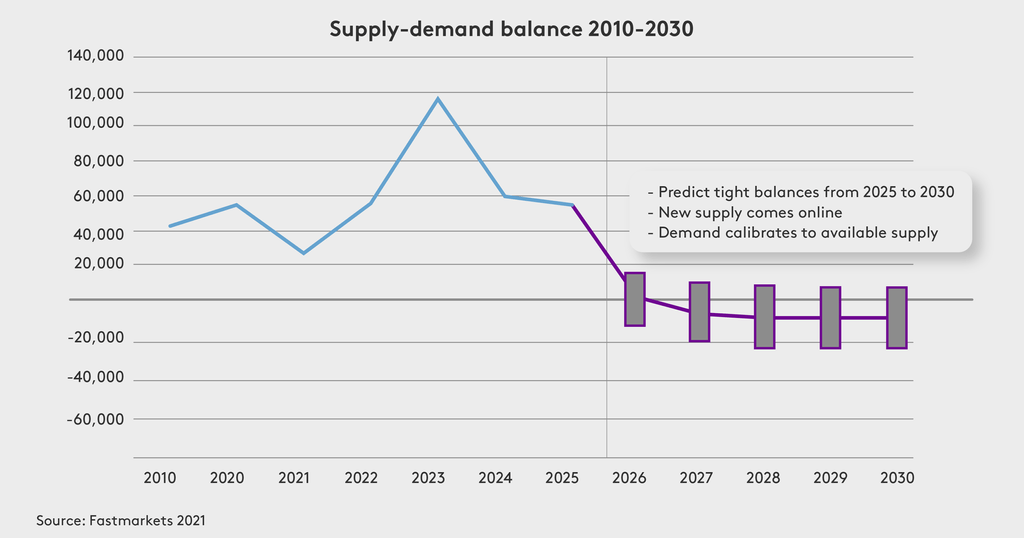

In the second half of 2020, lithium demand started to rebound, prices continued to fall until late September as the market destocked, but prices fell to unsustainably low levels, which prompted production cuts – these led to a price rebound as the market switched from destocking to restocking. Demand continues to rise in 2021, but supply is still tight. We forecast excess supply of just 3000 tonnes lithium carbonate equivalent (LCE), down from 54,000 tonnes LCE in 2020.

What’s driving lithium demand?

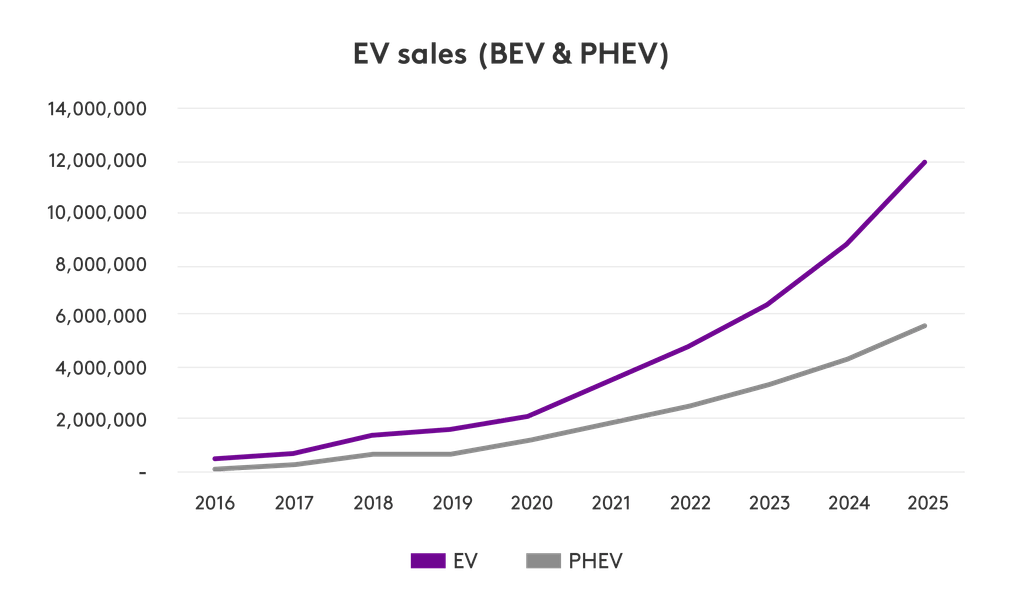

The only way is up for lithium demand. Electric vehicle (EV) demand will continue to drive the lithium market forward: EV penetration will reach 15% in 2025, and we expect to see it rise to around 35% by 2030. Add to that mix growing demand from applications such as energy storage systems (ESS), 5G devices, and Internet of Things (IoT) infrastructure.

The main takeaway here is that the EV market faces many decades of strong, compound growth. For any supply chain that relies on getting raw materials out of the ground, it is going to be a supreme challenge to keep up with year after year of high compound growth. For example, 25% growth on 300,000 tonnes LCE, means an extra 75,000 LCE is needed the following year and the year after that an extra 93,750 tonnes, on top of the previous year’s 75,000 tonnes, is needed. And, in this example we are only talking 25% CAGR, but growth in the early years could be a lot faster.

What’s the lithium supply-demand outlook out to 2030?

The underlying market fundamentals for lithium are straightforward: Increasing and sustained demand will strain supply through 2030. Between now and 2025, supplies from current and planned projects are expected to come online to meet demand; and from 2025 to 2030 new supply sources must come online to support demand.

Looking ahead to 2030, rapidly growing demand will test the market’s ability to expand supply and reduce lead times. But we believe the market will ultimately respond, and demand will calibrate to available supply.

Find out what’s driving demand, where much-needed additional supply might come from, and what market signals to keep an eye on. Get your copy of our latest lithium report, Why there’s still time to avoid a lithium supply crunch.

Where will additional supply come from?

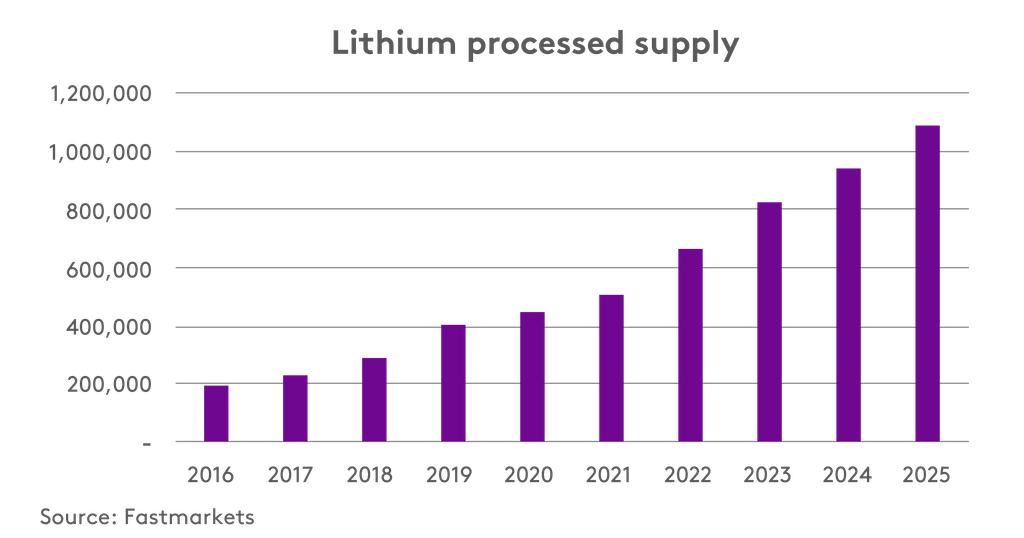

A total of 345,000 tonnes of processed lithium were produced in 2020, dominated by resources from the lithium triangle and Australia. Lithium production must quadruple between 2020 and 2030 to meet growing demand, from 345,000 tonnes in 2020 to 2 million tonnes in 2030.

Additional supply will come from multiple sources including investment in hard rock production in Australia, direct lithium extraction and recycling infrastructure. Read our special lithium report, Why there’s still time to avoid a lithium supply crunch, to understand likely sources of future supply in more detail.

Find out more about our lithium prices.