In this report, we will share the tin round-up, a quarterly report that was written on January 9, 2024. This report was shared to all subscribers to provide a clear visualization of the risk to reward, the dominant trend and to identify key support and resistance levels.

We wrote in the report in January that the dominant trend on LME tin is a bear market rally at work.

Below are the excerpts from the report:

This is a bear market rally that we have been anticipating since our third quarter round-up report (2023) in which we wrote in detail that dips should remain bought because the tin price could produce a bear trap first, before moving higher.

While there is no absolute certainty that the previous price structure will continue to work, we remain confident that should it work, the LME tin price would be able to break north of $28,000 to $29,000 per tonne before it starts to consolidate.

We suspect that global supply uncertainty, especially coming from the Myanmar Wa state, will play its role in supporting higher tin prices. Additionally, improving macroeconomic conditions, backed with positive seasonality, should attract fund managers to turn net long on tin again.

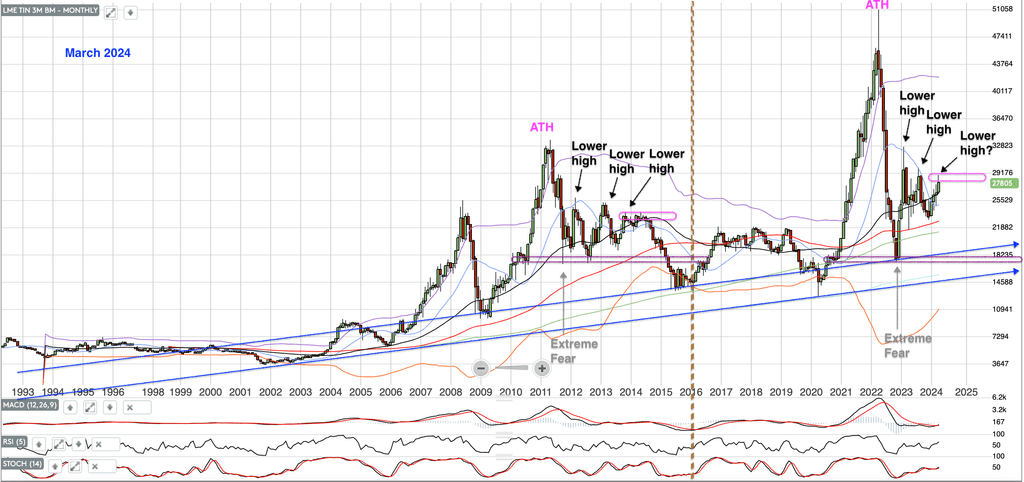

Let us compare the LME tin monthly chart that we inserted in that January report to the latest chart.

January report

Latest LME tin monthly chart

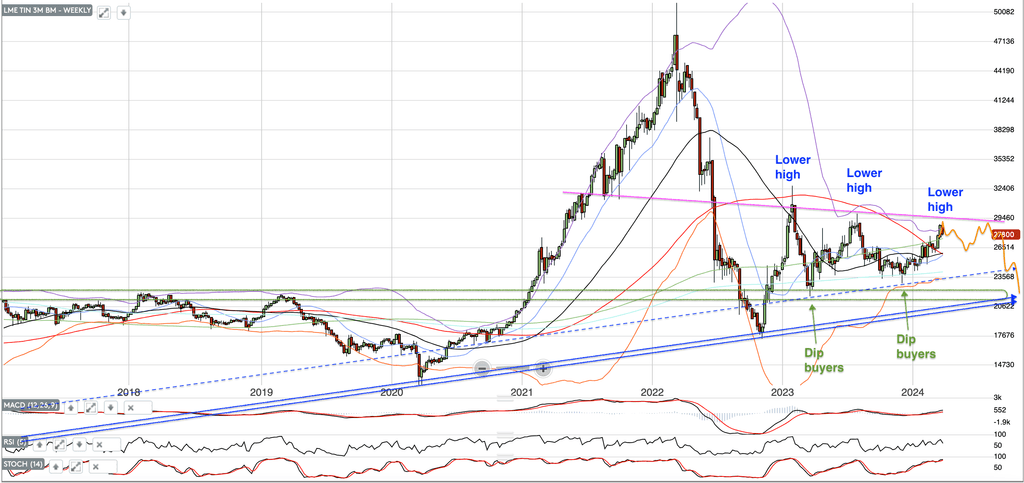

Here are the weekly charts for comparison:

January report

Latest LME tin weekly chart

While in hindsight, everything seems so clear and easy to follow, Fastmarkets Research aims to bring the most trusted analysis to give subscribers the best knowledge, probability, support and resistance.

We also offer as a clear, visual outlook to enhance the decision-making process by offering in-depth market analysis for the base metals market.

To understand the complex market conditions influencing price volatility, download our monthly base metals price forecast. Get a free sample.