The final touches are being made to Fredrikstad’s Hydrovolt factory, a joint venture between aluminium producer Norsk Hydro and battery producer Northvolt that will recycle 8,000 tonnes of EV batteries per year when ramped up – making it one of Europe’s top plants for the sector.

The plant comes at a key time in Norway, which last year became the first country to sell more electric cars than those powered by internal combustion engines, putting the Scandinavian nation at the forefront of a transportation megatrend that is poised to be emulated across the globe.

“Hydrovolt will be big in European terms, but several more facilities like [it] are required to meet the future demand for recycling capacity in Europe,” Hydrovolt chief executive officer Fredrik Andresen told Fastmarkets in an interview.

While other countries – from China to the United States – sign up for lofty climate goals that require a drastic shift toward electric car use, the trend is proving a rich area for start-ups and government-backed groups looking to tackle the substantial hurdle this creates, namely how to recycle a new generation of batteries to power those cars.

“In terms of the significant waste management problem that’s coming down the line, it’s something we have to invest in, although there are promising signs from the industry,” according to Gavin Harper, a research fellow at the United Kingdom’s Faraday Institution, a combination of research institutions throughout the country that explore the future of battery development.

The batteries that currently power internal combustion engines in most cars have a simple recycling solution. The lead-based battery holds the vehicle’s electrical charge, the metal gets removed from a spent battery, remelted into ingot, shaped again into charging plates and then made into a new battery. The process for collection and recycling these batteries has been built and refined since closed-loop batteries became commonplace in the 1970s.

But for the new wave of EV batteries, the recycling of lithium-ion, nickel-cobalt, H11 and H811 is still in its infancy.

“With electric vehicle batteries there’s such a diversity in terms of the different sizes, factors, chemistries, that’s a singularly more difficult challenge, but not one that’s insolvable,” Harper said.

Battery boom

The statistics are sobering.

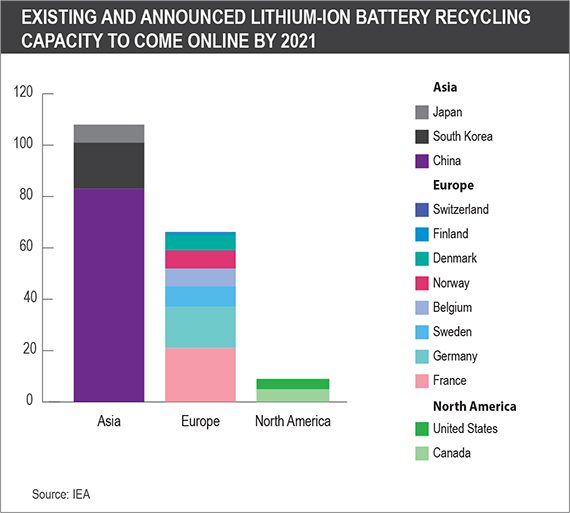

By the end of 2020, 10 million EVs were used globally, according to the International Energy Agency (IEA); that figure is expected to increase to 145 million by 2030 for vehicles not including two- or three-wheeled modes of transportation. In contrast, the agency said that the worlds capacity to recycle new energy vehicle (NEV) batteries currently stands at 180,000 tonnes per year.

While demand on this scale is expected due to international carbon-reduction targets, it is less certain how supply chains will be able to react to mine and process the vast amounts of metals and minerals needed for production.

“With the electric vehicle and energy storage markets set to see decades of strong growth, the raw material supply chains are going to struggle to keep up,” Fastmarkets head of battery metals analysis Will Adams said.

“This means that as the market grows, so too will the recycling of old lithium-ion batteries. Recycling will be essential to help producers keep up with demand and will also be mandatory as corporations and governments focus on sustainability,” he said.

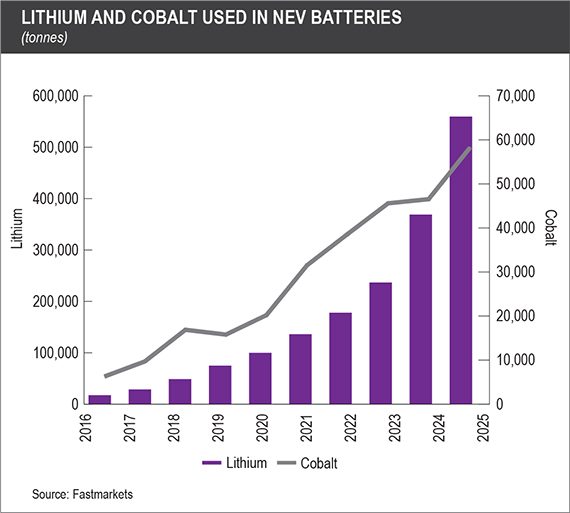

The boom in electric vehicle usage will require a substantial increase in critical metals, such as lithium and cobalt.

Fertile ground for start-ups

Companies like Hyrdovolt are just beginning to scale technology and processes that could become key methods in tackling a future battery-waste problem.

In North America, battery recycling start-up Li-Cycle has built two plants – one in Canada and the other in New York, in the United States – that each have a battery processing capacity of 5,000 tonne per year.

The company uses robots to shred batteries of all kinds, sorting the remnants into what the industry terms “black mass” – a mineral-rich slurry from which individual metal sulfides or carbonates can be extracted.

Most battery recyclers combine a combination of pyrometallurgical, hydrometallurgical and mechanical recycling; while the pyrometallurgical process enables the extraction of cobalt, nickel and other pricey metals, the hydrometallurgical and mechanical processes allow lithium to be recycled along with the non-chemical parts of the battery – such as aluminium and copper.

Li-Cycle plans to expand further in North America and into Europe in the coming years, chief commercial officer Kunal Phalpher told Fastmarkets in March.

“The goal is to create a secondary supply, or additional supply, for critical battery materials, so that’s really the driving force of why the business started. But as the need for critical materials grows, the demand for more sustainable solutions on the end of life are required,” he said.

Investors see money in it too; Li-Cycle said earlier this year that it will transition to a publicly listed company via a special purpose acquisition company deal valuing it at $1.67 billion.

Redwood Materials, a US rival founded by former Tesla chief technology officer Jeffrey Brian Straubel, is valued at $217 million, according to private market data provider PitchBook, having recently taken on investment from Amazon and Capricorn Invesmtnet Group.

The company has the capacity to process 20,000 tpy of batteries at its two facilities in Carson City, Nevada, a spokesperson said.

This all pales in comparison to companies in China, South Korea and Japan, where the scale of recycling has already hit its stride.

Chinese battery raw materials producer GEM, for example, is expected to recycle 30,000 tonnes of batteries this year and is in the process of constructing a plant in Jiangsu that will process more than 100,000 tonnes of battery cells into 30,000 tonnes of nickel, cobalt and manganese battery precursor, along with 10,000 tonnes of cobalt tetroxide, according to London-based consultancy Circular Energy Storage, which tracks new energy vehicle battery recycling.

China is expected to remain the central hub for global NEV battery recycling, according to the IEA.

Future economics

The economics of recycling lithium-ion batteries are still being worked out; typically, Li-Cycle, Hydrovolt and others claim around 97% extraction rates of the elements being recycled, but this isn’t always enough to turn a profit.

“Because the value inside the battery cells – so the amount of cobalt, nickel, lithium and manganese that you recover – is so low in EV batteries, you won’t break even for now if you don’t have an upfront gate or processing fee,” Andresen said.

Many recyclers receive a fee to take on scrap material, although this could change if battery metal prices continue to soar.

A report by Element Energy estimates that scale and technological developments will cause recycling fees to drop to around $480 per tonne in 2030 from $1,700-2,000 per tonne of battery waste currently, with an assumption that cobalt content in batteries does not drop significantly.

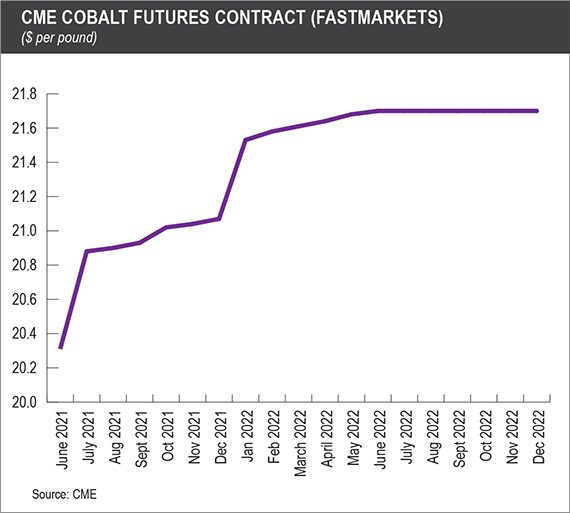

The reduction of high-priced cobalt in battery chemistries could be a hurdle for those operating low-volume plants.

CME Group’s cash cobalt metal contract, which is settled against Fastmarkets’ daily benchmark cobalt price assessment, is trading at $20.31 per lb ($44,775 per tonne) for June, with the June-December 2022 futures contracts trading at $21.70 per lb.

Traders are pricing in an expected increase in demand for cobalt on the CME futures forward curve.

Automakers such as Tesla and Volkswagen have been open in their goals to reduce the amount of cobalt used in batteries for new cars, both for cost and political risk reasons; half of the world’s cobalt is mined in the sometimes volatile Democratic Republic of the Congo.

But the first EVs beginning to roll into scrapyards should provide the scale recyclers need to economically process batteries, regardless of cell chemistry, Harper said.

“It’s really about the volumes and scale of the waste problem about to increase, lithium-ion batteries have been around for a long time but it hasn’t been until now where recycling really makes sense,” he said.