After factoring in fixed costs and the Clean Fuel Production Credit (CFPC or 45Z), net margins remained sharply negative for biodiesel producers.

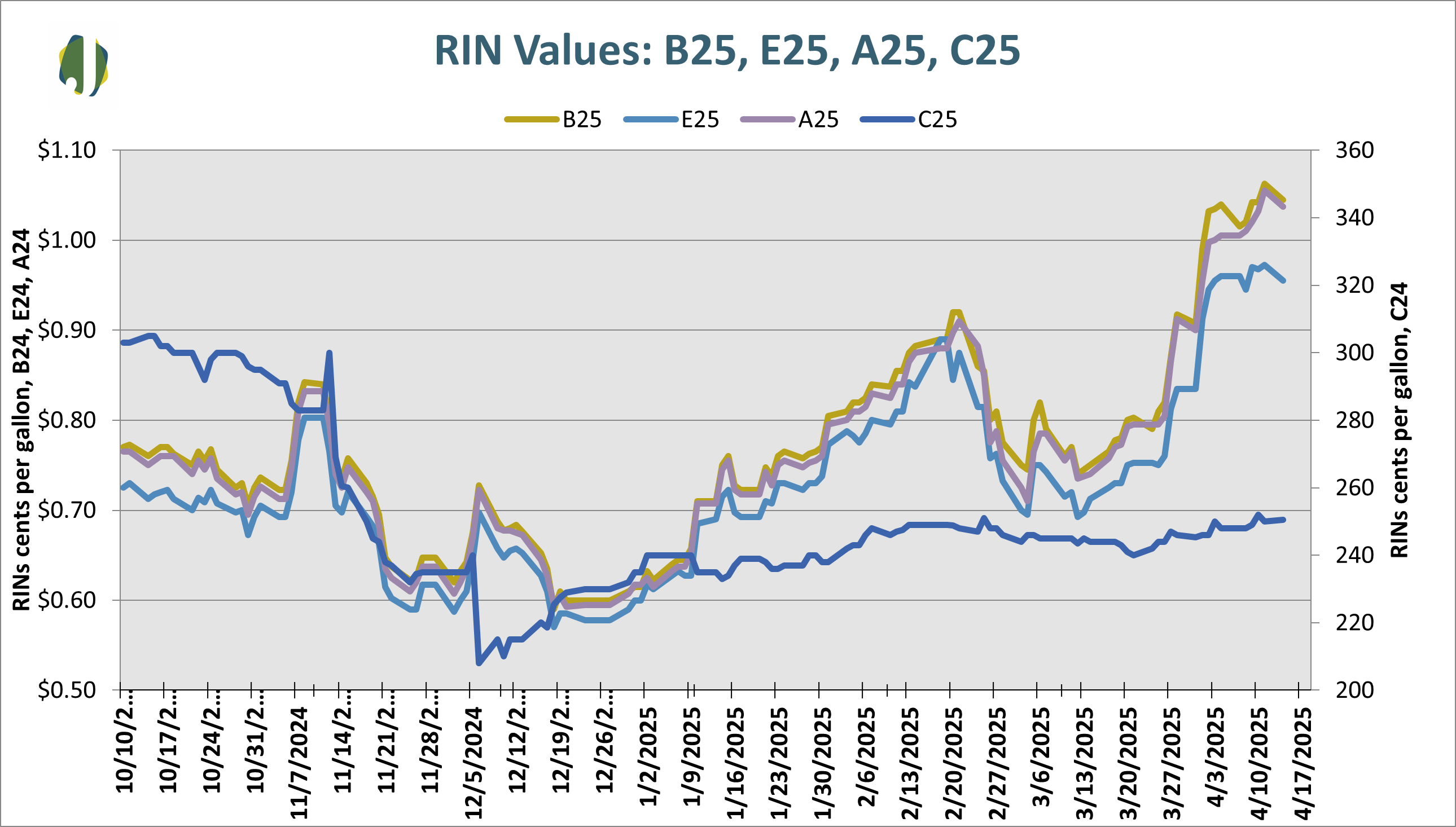

Renewable identification number (RIN) prices have made a strong run over the past several weeks. They were up by 32% over the three-week period ended Friday. RINs closed the week at their highest price since September 22, 2023.

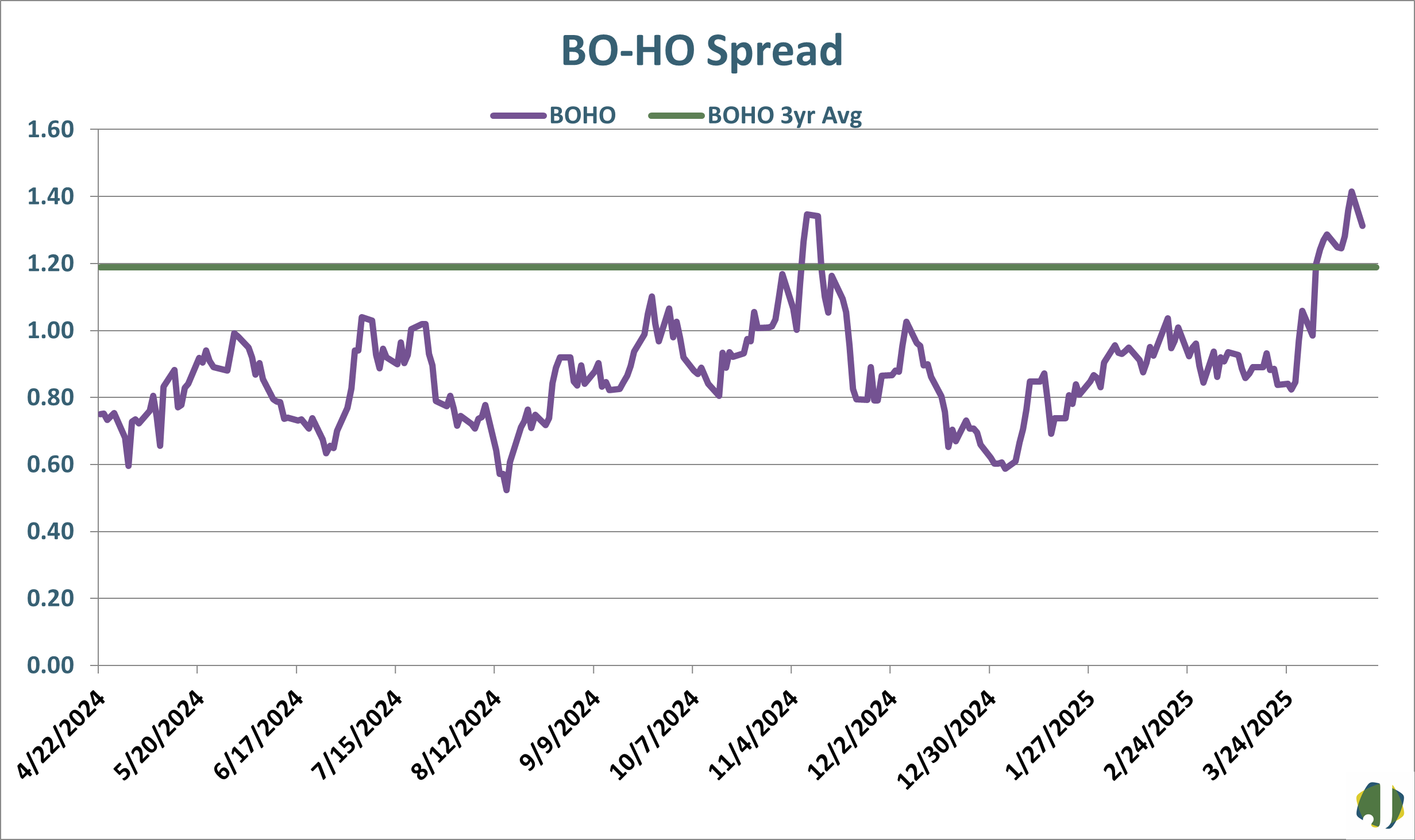

While market participants often say that they need RINs to rise to make biodiesel/renewable diesel production profitable, what they really mean is that they need RINs to rise faster than the soybean oil/heating oil (BOHO) spread.

The BOHO measures the profitability of producing biodiesel from soybean oil. The higher the spread, the more costly the production. RIN prices often rise to offset the increase in production costs.

Unfortunately for producers, RIN prices did not keep pace with the rising BOHO over the past three-week period. This led to a continued deterioration in margins.

The BOHO spread climbed by 68% during this period, while RINs managed to climb by 32%. During the latest weekly period ended April 11, the BOHO spread increased by 10%, while RINs only rose by 2%.

Vertically integrated soybean producers had been ramping up production to dispel growing soybean oil inventory from the ongoing soybean crush. Even in poor margin environments, they can afford to do this due to positive soybean crush margins or as an effort to provide value within the entire soybean chain.

But many vertically integrated producers are struggling as well and questioning why stand-alone biodiesel operators would pick this point to restart production.

“I have been scratching my head [as to why stand-alone biodiesel operators] have been ramping up lately,” an integrated producer said. “The last time margins were this low, [they] were vocal about idling capacity. The production margins don’t make sense now.”

Daily charts

Anticipate price movements and supply and demand dynamics across global biofuel and feedstock markets. Learn more about Fastmarkets biofuels analysis and forecasts here. You’ll get the expert insights, customization and broader data consideration you need to negotiate with confidence and enhance your procurement strategies.