First published in the Battery raw materials market tracker published on June 1, 2021.

Now that commodity prices are experiencing strong rallies, there is as much talk about supercycles as there is about this not being a supercycle. More like a rally on the hiatus that followed the Covid-19 pandemic amid supply constraints, which were due to mining disruptions and shipping delays.

But, if you stand back and look at the big picture, maybe what we are seeing is a doubly bullish situation – constrained supply within a supercycle.

This might explain the more-than-strong moves in many commodity prices over the past 14-months and may well be a warning that we should expect higher prices across commodities, including the battery raw materials.

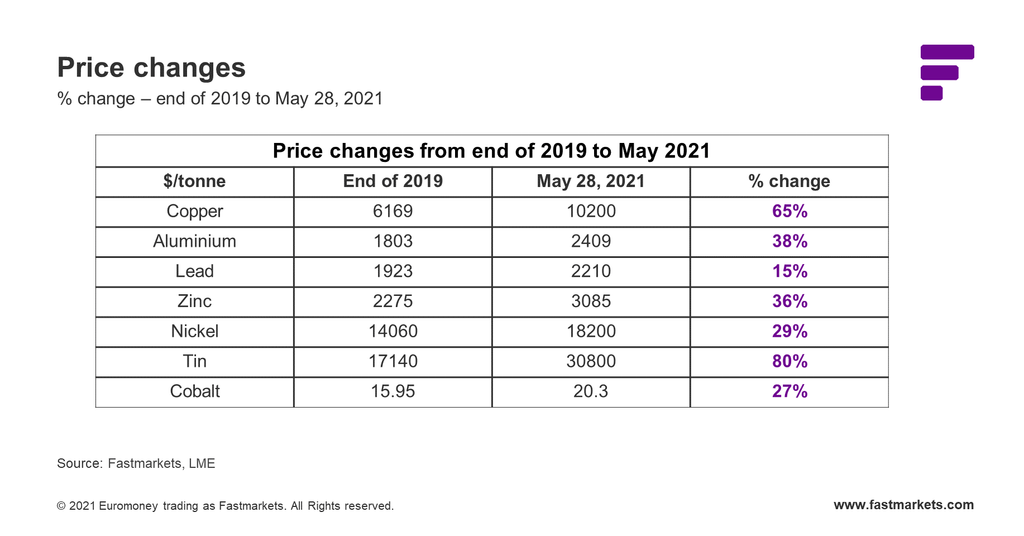

If we look at where prices were at the end of 2019, before Covid-19 struck, to where they are today, prices have indeed shot higher, which from a demand point of view is odd given the disruptions that demand has suffered from lockdowns. Although electric vehicles (EVs) are an exception here, EV demand has been much stronger as a result of government measures to tackle Covid-19.

Leading the rise has been tin, which is up 80% from the end of 2019, and lead recording the smallest increase at 15% but lead is one of the few metals that may actually suffer as a result of the electrification era because EV sales are taking market share from petrol/diesel cars (although auxiliary lead-acid batteries are still found in most EVs).

Surprisingly nickel and cobalt have relatively modest gains, up by 29% and 27% from the end of 2019 but both those metals have recently suffered significant pullbacks and the pullbacks are related. At their 2021 highs, these two metals were up 43% and 58% respectively, more closely aligning them with the gains made in the rest of the base metals (copper, aluminium, zinc, tin) and lithium, which on average are up by 53%.

The pullbacks in cobalt and nickel have partly come about after two of the largest EV manufacturers, Tesla and VW, talked about using more lithium iron phosphate (LFP) batteries, which would mean using less nickel-cobalt-manganese (NCM) batteries than originally thought.

As we move into the electrification and decarbonisation era, the world is set to transform massively. Not only will EVs dominate, they will require many different commodities than internal combustion engine vehicles (ICE-V), but renewable energy generation will also require different materials and will need support from energy storage systems (ESS).

These changes are running parallel with other developments, however, such as autonomous driving and the internet of things (IoT) that will require new infrastructure, much of which will be metal intensive.

We are also set to experience other structural changes. The disruption to trade that the US-China trade war (2018-219) and the pandemic caused have meant economies need/want shorter supply chains, which will require the rebuilding of more manufacturing locally and the use of more local raw materials where possible.

As it happens, this fits neatly with the quest to reduce carbon footprints. But, it will mean that factories in Asia that had supplied the world will now have to be rebuilt locally, which will take enormous amounts of resources, including labor.

The other factors that we think make the current situation a super-cycle are:

- The transition to a decarbonized era is the all-encompassing demand driver.

- The mining industry has experienced low levels of capex since 2012, which is now being felt because producers have fallen behind the curve and that means their ability to respond will be slow given how long it takes to build greenfield mines.

- The world is awash with liquidity while governments spend their way out of the Covid-19 hit, which raises the risk of monetary inflation while investors sell bonds to buy hard assets such as commodities.

There are many parallels with the mid-2000’s super-cycle.

- In the mid-to-late 1990s, capex was low,

- The Asian financial crisis (1997/98), the Long-Term Capital Management (LTCM) bailout, the dot.com recession and the 9/11 terrorist attacks, all contributed to central banks around the world opening up their liquidity taps.

- The demand driver back then was BRIC economies transitioning to emerging markets.

So why are we writing about this in terms of lithium? Because the demand outlook for lithium-ion batteries looks unparalleled, but we already know that. With everything else going on as aforementioned, including the need to mine more copper, nickel and other infrastructure raw materials, there may well be labor shortages that could affect developing new lithium projects and other battery raw materials.

Australia is already experiencing shortages – Albemarle, Mineral Resources, BHP and Fortescue Metals Group, and no doubt many others, have all said they are exposed to labor shortages and with many borders closed because of the pandemic, the situation is likely to get worse before it gets better.

In conclusion, we think lithium producers have a huge task ahead of them to ensure enough lithium will be available to the market in a timely manner. We are not just talking about having enough for 2025, when EV penetration may be at 15%, we face decades of strong, year-after-year, growth – it will be a tall order for producers to keep up with. But when we consider lithium in the context of all the other changes going on, the task may be even harder.

Visit our hub for more in-depth insights into energy transition and its impact on commodities markets or find out more about our Battery raw materials market tracker.