Wolfgang Bernhart has been working as a senior partner at Roland Berger since 2007. He supports automotive, industrial and technology clients globally. One of his core areas of expertise lies in the lithium-ion battery industry. Wolfgang will be delivering a presentation on electric vehicle (EV) and energy storage system (ESS) battery demand at the Fastmarkets Asian Battery Materials Conference.

Wolfgang Bernhart has been working as a senior partner at Roland Berger since 2007. He supports automotive, industrial and technology clients globally. One of his core areas of expertise lies in the lithium-ion battery industry. Wolfgang will be delivering a presentation on electric vehicle (EV) and energy storage system (ESS) battery demand at the Fastmarkets Asian Battery Materials Conference.

The Battery Materials Report was developed by the Production Engineering of E-Mobility Components (PEM) unit of RWTH Aachen University and Roland Berger. Fastmarkets showcased the first of the Roland Berger article series in March. This focused on battery materials supply, demand and sustainability challenges.

Click here to read the first report in this two-part series.

With supplies increasingly hard to source, OEMs and cell manufacturers are looking to make long-term sourcing agreements or make direct investments to secure raw materials. At the same time, they are investing in new methods to increase sustainability across the value chain.

The active materials used in batteries are critical to their performance and cost. Cathode active materials (CAM) and anode active materials (AAM) determine the efficiency, reliability, costs, cycle and calendar life, and size of batteries. Together these materials account for 60-70% of total cell costs with today’s raw material prices. With the boom in electric vehicles (EVs), demand for them is relentless. Yet the value chains of CAMs such as lithium and nickel are most likely not able to meet the demand in the future. This is putting pressure on producers, increasing competition and forcing manufacturers to move to secure their supplies.

This article, based on the Battery Materials chapter of the Battery Monitor 2022 report, outlines the challenges and technological developments in the materials sector. It is based on the five key performance indicators of sustainability, technology performance, competitiveness and innovation power.

Sustainability: Producers reassessing value chains to lower emissions and waste products

The mining and processing of CAMs produces significant waste products and CO2 emissions. To address this, the battery industry is trying to improve sustainability through new technologies and production methods.

Sodium sulfate is a burdensome byproduct of CAM production. By 2030, sulfate production is expected to reach over 4,000 kilotons based on announced cell chemistry roadmaps, meaning tailings will need to be better managed to limit environmental strain. New CAM production processes that avoid or safely remove sodium sulfates are in development to tackle the problem.

From mining to refining, CAM production is energy-intense. Depending on the production method, typical CO2 emissions from battery cell production are currently between 60 and 80 kilograms CO2 equivalent per kilowatt hour. Of these, CAMs account for 40 to 60 kg CO 2 eq/kWh. To tackle these emissions, some OEMs have set targets of below 30 kg CO2 eq/kWh at a cell level and below 20 kg CO2 eq/kWh for CAMs. Achieving this will mean overhauling supply chains, relocating closer to renewable energy sources and introducing novel recycling technologies (see below).

Technology performance: Higher nickel contents, nickel alternatives and silicon anodes the key focus

The current focus in battery development is on reducing the cost of cells, improving energy densities and increasing charging/discharging speeds, with energy densities already considered good enough for most applications. Once again, cathode and anode technologies are the key areas of interest.

In the former, the main push is towards ever-larger nickel contents (up to over 90%) in NMC (nickel, manganese, cobalt) compositions to increase energy densities, and simultaneously reduce ESG critical cobalt content to a minimum. However, with these almost at their limits, and with nickel prices continuing to rise, producers are also exploring the use of high-manganese chemistries as a compromise between lithium ferrophosphate (LFP) cells and high nickel-content NMCs. The substitution of lithium-ion technology with cheaper sodium-ion tech is another key area of research. The full report looks at the regional variations in cathode technology developments, with, for example, China focusing on developing advanced LFP and sodium-ion technology and Europe on high-manganese chemistries.

In anode technology, the race is on to develop better graphite and silicon solutions to increase energy densities and improve power capabilities, and thereby charging/discharging capabilities. As assessed in the full report, silicon technologies are a key area of research.

Competitiveness: With CAM prices soaring, OEMs must move to secure supplies

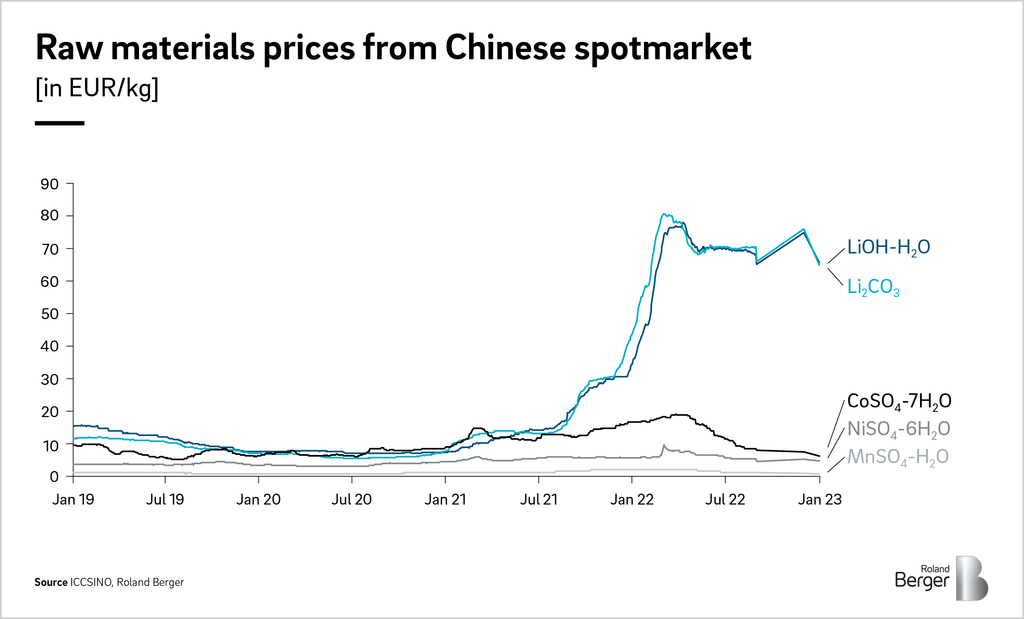

A battery maker’s competitiveness is hugely influenced by the way it secures raw materials, and therefore how much it pays for them. Material prices have soared recently; for example, between January 2021 and January 2022, LFP cell costs rose by almost 30% and NMC811 cell costs by just over 40%. Current price levels have lowered again, but Lithium prices are still on its peak. An overall higher cost level is expected for most materials than prior to 2022.

In the case of lithium, price rises have been driven by strong buyer activity, with many producers over-securing their supplies due to the irreplaceability of lithium. In the short term, the addition of new supplies is likely to ease the situation and lead to a gradual fall in prices. In the long term, demand for lithium is expected to remain strong, due to the current lack of viable lithium-ion substitutes and the long lead times of new lithium mining projects (up to seven years). The situation with nickel is remarkably similar. Overall, prices are now likely to stabilize.

To ensure security of supplies and prices below market level, players need to fully integrate with a miner/refiner. Vertical integration and investment in the value chain are therefore becoming immensely important. The full report looks at M&A activity across the different regions.

Innovation power: New CAM production methods aim to improve battery sustainability

The final chapter segment looks at new CAM production methods designed to lower the environmental footprint of battery production. Developments are largely split into two types: processes that can be adapted for use in existing setups and that offer incremental benefits, and completely new production approaches that significantly lower CO2 emissions.

In the first group, the full report looks at several promising methods. For example, gradient precipitation aims to reduce the amount of nickel present at the surface of the cathode, making the cell more efficient. It has the potential to significantly lower energy consumption, as a second calcination step can be omitted. Meanwhile, sodium hydroxide recycling avoids the production of sodium sulfate by instead recovering sodium hydroxide and sulfuric acid, which can then be used as input materials.

The game-changing technologies promise better results but are largely unproven. The full report discusses the likely contenders.

Whatever the method, it is clear that such novel technologies will be key if the industry is to ensure future sustainability.

Hear more from Wolfgang Bernhart

Hear Wolfgang Bernhart speak at the Fastmarkets Asian Battery Materials Conference 2023 in Singapore. He’ll be delivering a presentation on EV and ESS battery: Demand projections by region. See the event agenda for more details.

Secure your place today

This article was originally published in Roland Berger Insights.