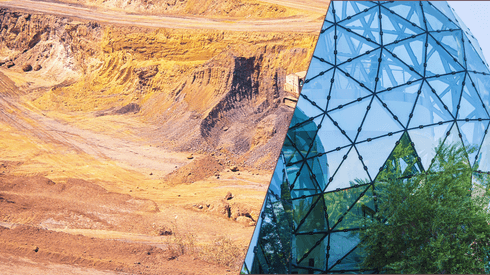

Metals and mining

Market-reflective prices and analysis to help you navigate volatile, opaque markets

Metals and mining market participants like you have been turning to Fastmarkets for help in evaluating opportunities and risks for more than 130 years. Supply chains are constantly moving and metals prices fluctuate while the lasting impact of Covid-19, the war in Ukraine and the pull of decarbonization create uncertainty in the market.

Fastmarkets metals and mining team works with those involved in the buying, selling and trading of metals to deliver truly market-reflective prices and insights to successfully enable global trade.

Combining the commodity intelligence of familiar names like Metal Bulletin, American Metal Market, Scrap Price Bulletin, Industrial Minerals and more, our product breadth and geographic reach remain unmatched.

Talk to our experienced, global team and discover more than 900 prices and news and analysis in primary and secondary metals markets. We cover base metals, industrial minerals, ores and alloys, steel, scrap and steel raw materials.

Aluminium scrap market news and analysis for aluminium scrap buyers, sellers and traders

Keep up with the movements of aluminium as one of the most-watched metals on the market

The trends and forces driving the cobalt market

Learn more about copper and view copper price charts

Get the latest ferro-chrome price charts and access the latest insights

Ferrous scrap, recycling and the circular economy

Get the latest galvanized steel price charts and access the latest price trends

News, price and analysis of the innovative world of synthetic and natural graphite

Follow the critical developments facing the iron ore market, including iron ore market forecasts and analysis and iron ore price data

How the lithium market is helping shape a greener future

Playing an essential role in building global infrastructure

The latest nickel scrap price trends for the global market

Keep track of the dynamics and volatility in the nickel market

Understand the forces shaping the tube and pipe market today

Get the latest zinc price charts and access our latest zinc price forecasts for the global market

Key prices

- Lithium Lithium carbonate 99.5% Li2CO3 min, battery grade, contract price cif China, Japan & Korea, $/kg (MB-LI-0027)

- Lithium Spodumene min 6% Li2O, spot price, cif China, $/tonne (MB-LI-0012)

- Iron ore Iron ore 62% Fe low-alumina fines, cfr Qingdao, $/tonne (MB-IRO-0144)

- Steel Steel scrap sheared HMS 1&2 (80:20 mix), index, domestic, delivered UAE, dirhams per tonne (MB-STE-0910)

- Steel Steel scrap HMS 1&2 (80:20 mix) US origin, cfr Turkey, $/tonne (MB-STE-0417)

Our global team of over 200 price reporters provides over 900 global metal and mining prices

Delivered to you as the markets are changing from reporters embedded in the global metals and mining markets

With an over 90% accuracy rating, our forecasting helps you understand what’s next for the metals and mining market

Grow and protect your profits and insulate your business from volatility with the Fastmarkets risk management team

Learn how the Fastmarkets platform can help you navigate the fast-moving metals market

Fastmarkets’ metals consulting is your partner in creating value and managing risk

Latest metals and mining news and market analysis

The US trade roller coaster ride seems to be flattening, with signs of potential moderation and stability. It appears increasingly likely that our original expectation that the US Trump administration would primarily use the threat of tariffs as a negotiating strategy will be correct. While we do not expect to the US tariff position return to pre-2025 levels, we believe the overall US tariff burden is more likely to settle at around 10-30% globally rather than the elevated rates of 50-100% that seemed possible in recent weeks.

The Mexico Metals Outlook 2025 conference explored challenges and opportunities in the steel, aluminum and scrap markets, focusing on tariffs, nearshoring, capacity growth and global trends.

China has launched a coordinated crackdown on the illegal export of strategic minerals under export control, such as antimony, gallium, germanium, tungsten and rare earths, the country’s Ministry of Commerce announced on Friday May 9.

Cobalt Holdings plans to acquire 6,000 tonnes of cobalt. Following their $230M London Stock Exchange listing, this move secures a key cobalt reserve. With the DRC’s export ban affecting prices, the decision reflects shifting industry dynamics

The recent US-China agreement to temporarily reduce tariffs is a major step for global trade, with tariffs on US goods entering China dropping from 125% to 10% and on Chinese goods entering the US decreasing from 145% to 30% starting May 14. While this has boosted markets and created optimism, key industries like autos and steel remain affected, leaving businesses waiting for clearer long-term trade policies.

The US-UK trade deal removes Section 232 tariffs on British steel and aluminium, reduces automotive tariffs and sets a framework for addressing global trade issues.

June 17-19, 2025 | Barcelona, Spain

The conference welcomes unparalleled number of steelmakers and top-level procurement executives, who are all looking at the pivotal shift in the steel manufacturing sector towards environmental responsibility and carbon neutrality. Join industry leaders, innovators, and peers at this highly anticipated gathering.

June 23-26, 2025 | Las Vegas, USA

The global flagship event for the lithium market is back, bringing you the leading experts from across the supply chain for a week of discussions, debate and networking.

September 16-18, 2025 | Europe

Secure a front-row seat for expert analysis and insights into the battery raw materials market – from the leaders and innovators shaping the industry.

September 24-26, 2025 | Indonesia

As demand for critical minerals rises globally, Indonesia is ideally placed to use its reserves as a strategic asset to negotiate trade deals, attract foreign investment, strengthen its geopolitical influence and become a global battery hub. Meet the key players from industry and government at this important event in Bali.

Whether you’re interested in learning how to become a customer from our sales teams or looking to get in touch with one of our reporters, we’re here for you.

Navigate uncertainty and make business decisions with confidence using our price data, forecasts and critical intelligence.